when are property taxes due in madison county illinois

Current Tax Year-Taxing District Levy Valuation and Tax Rate Information. Do not enter information in all the fields.

1 Ogle Estates Columbia Il 21056137 Real Estate Riverbender Com

In most counties property taxes are paid in two installments usually June 1 and September 1.

. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address. Property taxes are collected by the County Treasurer and distributed back to local governments. Madison County Auditor Financial Reports.

Madison County Property taxes are paid in four installments. Search Any Address 2. The exact due date is mentioned on your tax bill.

Your taxes are not paid until funds settle into our bank account. See Property Records Tax Titles Owner Info More. - CreditDebit Cards - 25 200 minimum - E-Checks - 150 per.

Statement of Economic Interest. Property tax due dates for 2019 taxes payable in 2020. Click here Pay your Madison County property taxes online.

Madison County collects on average 175 of a propertys assessed fair market value as property tax. You are about to pay your Madison County Property Taxes. Welcome to Madison County Illinois.

The first installment is due in July the second is in September the third in October and the last in December. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. For more information please visit Madison Countys Chief County Assessment Office and Treasurer or look up this propertys current valuation and tax situation.

Madison County is one of the few counties in Illinois that collects property taxes in four installments. If you are making payments after January 3rd due to interest and late fees please call our office at 256 532-3370 for an exact tax amount due. If you have any questions of your tax collector please email mctaxcollmadisoncountyalgov.

Madison County Auditor Check Register. Any questions on Tax Sale procedures and delinquent property lists. Property tax is a local tax on real estate land buildings and permanent fixtures that is imposed by local taxing districts and is based on a propertys value.

Main Street Suite 125 Edwardsville IL 62025. The median property tax in Madison County Illinois is 2144 per year for a home worth the median value of 122600. The tax buyer who bids the lowest rate of interest from 18 down to 0 pays the County Treasurers office the total taxes that were due plus costs associated with the sale and fees.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes. The median property tax on a 12260000 house is 214550 in Madison County. And is non-refundable pursuant to Illinois law.

Madison County has one of the highest median property taxes in the United States and is ranked 388th of the 3143 counties in order of. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Pay your Madison County Illinois property tax bills online using this service.

County boards may adopt an accelerated billing method by resolution or ordinance. LAST DAY TO PAY PROPERTY TAXES FOR TY 2020 ON OUR WEBSITE WILL BE FEBRUARY 18 2022 at 430 pm. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. Madison County Treasurers Office 157 N. In addition to July 9 due dates.

Cook County and some other counties use this. What is property tax. The median property tax on a 12260000 house is 128730 in the United States.

The tax sale in Clinton County is held annually in December month may vary slightly. Tapestry - Land Records via the Internet. When are taxes due in Madison County.

Real Estate Tax Frequently. When searching choose only one of the listed criteria. 173 of home value.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. The median property tax on a 12260000 house is 212098 in Illinois. Tax amount varies by county.

Illinois Property Tax Made Simple Ish

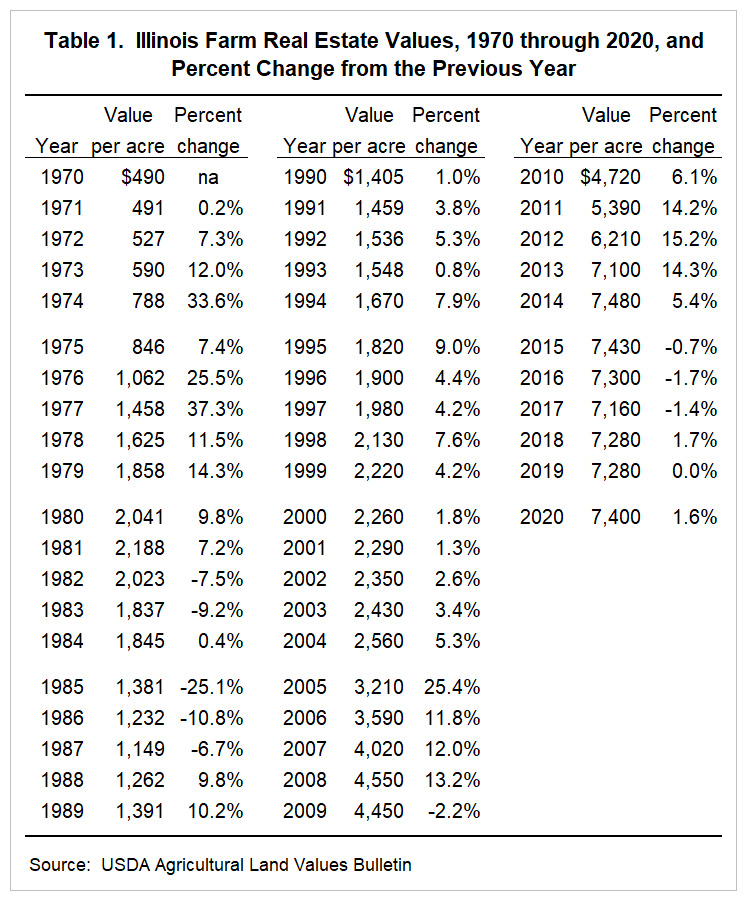

Slight Increase In Illinois Farm Real Estate Values For 2020 Farmdoc Daily

Illinois Sales Tax Guide For Businesses

U S Steel Plant Trump Saved Slated To End Steelmaking Forever Bloomberg

Homes For Sale Real Estate For Rent

Information On 2021 Cash Rents With Implications For 2022 Farmdoc Daily

Illinois Property Tax Exemptions What S Available Credit Karma

Tax Lien Registry Tax Lien Registry

Seiu Healthcare Il In Facebook

Illinois Laws On Rent Increases Fee Limits Upd 2022

Information On 2021 Cash Rents With Implications For 2022 Farmdoc Daily

Squatter S Rights Illinois 2022 Adverse Possession Laws

Illinois Eviction Moratorium Remains In Effect Through July 24 Illinois Realtors